While Freelancing and Blogging was a fresh field a few years ago, Payments across the globe were only feasible through PayPal.

PayPal is an online money transfer platform that facilitates payments between parties. It has a mobile app and a website, which allow users to open an account and link it to a credit card, debit card, or both.

Through PayPal, users can send and receive money online from other parties. In addition, millions of small and large enterprises trust PayPal payments.

Key features include:

- It offers automatic currency conversion, enabling users to send and receive money in a variety of currencies.

- To make it easier for clients to pay for goods and services, users can create and send professional invoices.

- It uses industry-standard encryption to safeguard user’s financial information.

Despite PayPal being a renowned and frequently used payment system, there are still situations in which individuals and businesses would rather look into alternatives:

- To accommodate a broader range of client preferences or to reduce the risks associated with depending solely on one payment platform, some users prefer having various payment methods.

- It charges high fees for transactions, especially when goods and services are being paid for. This shifts users to look for other alternatives that impose low fees.

- The currency conversion fees may incur additional costs as compared to other payment platforms.

It is essential to consider variables such as transaction volume, business requirements, and global reach when assessing PayPal alternatives.

This, however, has altered today and there are quite a few PayPal alternatives that guarantee easy payments across the nation for those freelancers and customers who found PayPal to be obstructive.

These are genuine ways of getting your cash electronically in no time at all. Most PayPal alternatives have PayPal-like websites and each has different features.

So, if you are a freelancer who is not able to take cross-border work because you do not have a PayPal account, then worry no more!

Below, we have listed some of the best money transfer sites for your easy access, so that you do not have to struggle to go through the long process of creating a PayPal account!

The list is in no particular order and you can choose whatever suits you best.

1. Payoneer

Payoneer will not charge you for signing up but will reward you a $25 bonus on the transaction amount of $1,000. They have different fee level which depends on the mode of payment.

For instance, for direct credit card payments, 3% of the transaction amount is charged. A Fee of $1.50 will be charged for transferring the money to a local bank and on withdrawing money in another currency, an account fee of 2% of the transaction amount will be charged.

Although opening an account in Payoneer is a simpler process, the downside is that their transaction fees are a little higher as compared to Stripe or Paypal.

2. Stripe

Lower charges, ease of use, and seamless inclusion into famous WordPress eCommerce platforms such as WooCommerce and Shopify are the best part of using Stripe.

By using all significant debit and credit cards accessible in over 13 nations, you can also create freelancer payments using stripes.

Stripe can be used to accept one-time payments and even to accept recurring payments. Therefore, you can use this payment technique for no fixed or monthly fee and be truly global with an online business as a blogger or freelancer.

There are no fees for installation or any monthly fees. The cost of a transaction through Stripe is 2.9%+ 30 cents per transaction.

3. TransferWise

TransferWise is one of the cheapest alternatives to PayPal. Its multi-currency borderless account can help your freelancing business, as you can receive money at a very minimal fee.

It has a transparent pricing approach and it sticks to flat pricing. You just need to create an account in Transferwise and send a payment request to your customer.

The customer can easily create an account and can pay the money through their credit cards. All the platform fees or transaction fees will be levied on to your client.

4. 2CheckOut

Also known as 2CO, 2Checkout has many favorable reviews and is regarded as PayPal’s best alternative. 2CheckOut provides 45+ different payment methods and 130+ currency options in more than 200 countries around the world.

Although it doesn’t support direct transactions and requires you to use other invoicing software, it processes payments via credit cards and also allows you to accept payments through PayPal without a PayPal account.

It’s simple to get on board with 2CheckOut and their assistance is fairly great to help you have a smoother experience.

5. Skrill

Skrill is another Paypal alternative, and better than Payoneer. To begin with, you create an account, make payments, withdraw funds, and use the Skrill prepaid MasterCard to shop around the world or withdraw from an ATM.

There is also an Android and iPhone app that enables you to use your phone to handle your transactions.

6. Remitly

Remitly runs excellent advertising deals and there’s no charge for transfers over $1000. By merely logging into your account and transferring cash to your card, payments can be made by credit card or debit.

You also have a fee-free choice to send payment, but that takes up to 3 days. We think it is a good option if you’re not in a hurry.

Also, if you are in India, it gives you nationwide coverage, and you can transfer money to more than 130 banks!

7. Instamojo

Instamojo is a firm based in Bangalore that aims to sell digital goods and collect internet payments. Use @username or email address to send payment to other Instamojo users rapidly.

Similarly, by giving your username to others, you can receive payment. Instamojo provides different alternatives for entrepreneurs and freelancers of today’s age. There are no setup fees and they charge you only 2% + Rs.3 for every successful transaction.

8. Google Pay

An article without Google?? Difficult to write! Google Pay is a very easy-to-set-up option and by far the best Paypal alternative! It is my favorite because it hardly takes 2 minutes to set up and there’s no transaction fee!

Your client just needs to have a credit/debit card linked to the Google Pay wallet, and for every transaction to be made, the user just needs to enter the OTP or the password.

You can easily send out payments from your smartphone and it can be done online or in person, and with Google, you can rest assured about security.

9. Dwolla

If you are somebody who is looking for frequent bank transfers, then Dwolla can be another alternative for you. In contrast to PayPal, Dwolla does not use Cards. Rather, connecting directly with your bank account, it promotes the transfer of funds.

Now, the best part about removing card usage is that the transaction costs are kept low. In reality, Dwolla is helping everyone with a smartphone to send cash at the lowest possible cost.

Dwolla doesn’t charge for transactions amounts less than $10 and for every transaction exceeding $10, has flat pricing of $0.25. Thus, if you are a newbie and you are worried about transaction charges, Dwolla is the solution.

10. Revolut

Revolut is an online payment platform serving over 35+ million customers providing extensive services, including savings, investing, currency exchange, and more.

In addition, Revolut allows users to send and receive money to more than 160 countries, obtain commodities like gold and silver, and get a free or paid card.

Revolut provides security features such as 24-hour monitoring and FDIC protection for cash deposits. With Revolut, users can retain and manage over 150 currencies, making interbank currency conversions and international transactions effective and convenient.

Besides that, it provides corporate cards, multi-currency support, and cost management for business accounts.

Some of the benefits that come with using Revolut include:

- Transparent and affordable costs for sending and receiving money in over 29 currencies.

- Investing with fractional shares and commission-free trading in stocks, ETFs, and cryptocurrency.

- Obtaining interest on deposits of up to 4.75% AER/Gross (variable).

- Obtaining a credit card that fits your needs and provides discounts and cashback.

- Using open banking to link and access all of your bank accounts from one location.

11. Venmo

Venmo is another online payment service that enables users in the US to send and receive money via a mobile application. It is owned by PayPal, and it allows users to send and receive money, split bills, and pay for goods and services.

Venmo has the following cutting-edge features:

- You can transfer money using your bank account, credit card, or debit card in a matter of minutes.

- Venmo allows you to customize your payments with notes, emoticons, or animated stickers. You can also change your privacy settings to control who can see your payments.

- Ethereum, Litecoin, Bitcoin Cash, and Bitcoin are the four different cryptocurrency types that can be bought and traded on Venmo for as little as $11. For stocks and ETF investments, there are also commission-free trading options and fractional shares available.

12. Airwallex US

Airwallex is an online payment platform that offers a range of financial services and cross-border payment options, such as business banking, international money transfers, and foreign exchange options.

US-based businesses can use Airwallex to access a wide range of services, such as multi-currency accounts, online payments, high-speed transfers, and cards.

More than 100,000 businesses trust Airwallex, and its mission is to facilitate the global expansion of contemporary businesses.

13. Aspire

Aspire is a payment platform that provides individuals and businesses with a comprehensive financing solution. Its platform focuses heavily on offering payment, money management, and credit access solutions to businesses.

Top features include:

- It offers business accounts that allow users to access extensive services, including Internet banking, debit cards, and payment processing.

- It enables users to send and receive money in over 30 currencies and provides low, transparent fees.

- It allows you to assign team members virtual and physical cards, as well as establish guidelines and spending limits.

- It offers versatile financing options such as credit lines, invoice financing, and revenue-based financing.

14. Zelle

Zelle is a digital online payment network based in the US that allows users to transfer money directly between bank accounts. It can be accessed through the Zelle app, or it can be integrated with the mobile apps of many major banks.

Key features include:

- It allows users to send money directly from their bank account to others’ bank accounts using their email address or mobile number.

- Zelle employs encryption and other security components to help protect users’ financial information during transactions.

- For money transfers between users who have signed up, Zelle typically does not charge fees.

15. OFX Global Currency Account

You can pay bills in local currency when you have an OFX Global Currency Account. You can also send and receive money in a variety of currencies with the account.

The Global Currency Account is a product of OFX, which offers services for international money transfers and currency exchange.

The following are some merits of using the Global Currency Account:

- When you transfer money to more than 50 currencies, you can avoid paying exchange rates and fees.

- Payments in seven currencies (HKD, USD, SGD, AUD, CAD, EUR, and GBP) can be accepted by accessing account information.

- It enables you to connect your account to Xero, payment gateways, and marketplaces.

- Not only are transactions safe and regulated, but customer support is available 24/7.

16. Xoom

Xoom is a PayPal service that makes cross-border bill payments and international money transfers possible. In addition, it allows users to send money overseas and offers a user-friendly platform that supports a wide range of currencies.

Top features include:

- Accepts multiple payment methods such as bank accounts, credit cards, debit cards, and others.

- 24/7 Service: Users can access the 24/7 services at any time as the platform is always open.

- It stresses more security by using encryption and other protocols to safeguard financial information and transactions.

- It gives users the freedom to contact customer support for assistance with any questions or concerns they may have.

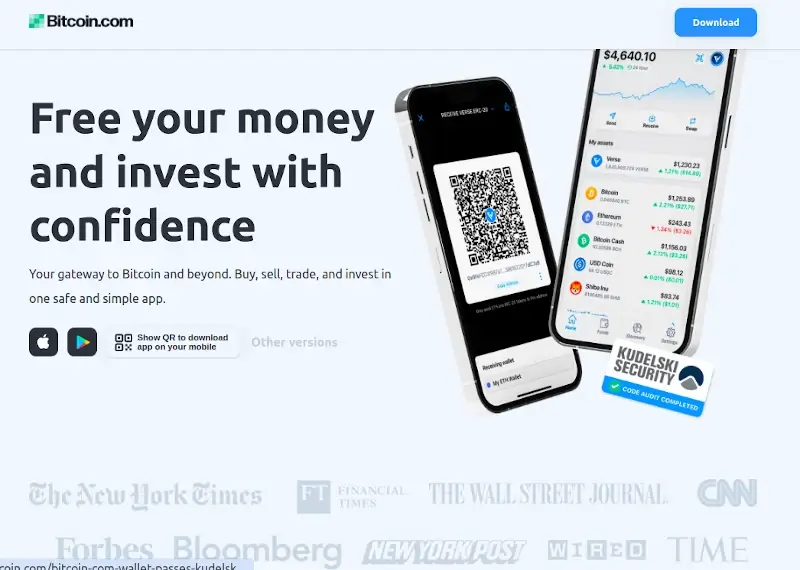

17. Bitcoin

Bitcoin is a digital currency that functions via a decentralized computer network, eliminating the need for a middleman or central authority.

Bitcoin creates new bitcoins through a process known as mining and employs cryptography to secure transactions. The blockchain, a public register of Bitcoin transactions, maintains transparency and prevents double-spending.

In addition, Bitcoin can be used for several purposes, including e-commerce, donations, remittances, online payments, investment assets, and a store of value.

According to the Bitcoin protocol, there will only ever be 21 million of these coins. This scarcity is set in this way to prevent inflation and produce a deflationary asset.

On top of that, the price of Bitcoin is known for its extreme swings, frequently experiencing significant value shifts over short intervals. Factors such as market demand, adoption, macroeconomic trends, and regulatory news influence its price.

Bitcoin packs the following functionality out of the box:

- It allows users to send and receive Cryptocurrencies without issue, at any time and anywhere.

- Real-time market data is presented on your home screen to help you stay informed.

- It allows users to create “spending” and “savings” wallets to keep their money organized. In addition, users can access a full history of all purchases, sales, swaps, and expenditures by adding personal notes to transactions.

18. Coingate

With CoinGate, you’re able to exchange, purchase, sell, and accept cryptocurrencies as payment. You can choose from 70+ cryptocurrencies and take advantage of minimal costs, safe transactions, and customer assistance.

The benefits that come with using Coingate include:

- Purchase, exchange, and sell over 100 coins.

- Convert your profits to other coins, such as Bitcoin and fiat money.

- Accept cryptocurrency payments for a flat 1% charge.

- Use cryptocurrency at online retailers and on gift cards.

19. Razorpay

Razorpay is an online payment platform that offers extensive funding solutions to Indian internet-based businesses. You can start business banking with Razorpay, process payments, pay employees automatically, apply for credit and loans, and receive payments.

Razorpay also ensures security and compliance, offers a sophisticated dashboard, and accepts more than 100 payment options.

Key features include:

- There are no out-of-pocket expenses required to begin receiving payments online.

- With the help of robust dashboards and reports, you can monitor and evaluate your payment performance as well as customer behavior.

- You can instantly receive money by creating and sending your clients expert invoices.

- By integrating Razorpay with your current systems, you can automate your payment workflows.

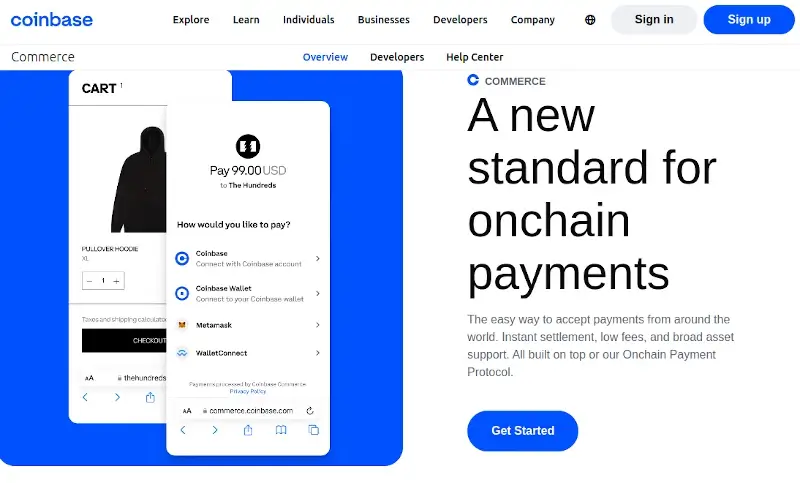

20. Coinbase Commerce

Coinbase Commerce is a cryptocurrency exchange that is compatible with numerous digital currencies, including Dogecoin, Ethereum, and Bitcoin. In addition, Coinbase Commerce seeks to improve cryptocurrency payments’ security and usability for customers and merchants alike.

Coinbase Commerce offers the easiest method to begin taking cryptocurrency payments: The following are merits associated with using the service:

- Easy onboarding: With streamlined onboarding or out-of-the-box integrations with platforms like WooCommerce, Primer, and Jumpseller, you can accept your first payment in a matter of minutes.

- Coinbase Commerce automatically converts the currency that your client has chosen to USDC.

- Quick, error-free payments are ensured, and you can get money directly into your wallet.

- Just a 1% transaction fee and no chargebacks to handle.

21. WebMoney

WebMoney was founded in 1998 as a global payment gateway for online retailers. Since then, the system has attracted over 45 million users from all over the world.

You can make safe transactions, track money, and get funding with WebMoney. These units of value are pegged to real-world currencies such as the US dollar, Euro, or Russian ruble.

Besides that, users can exchange the units within the system or use them to pay for goods and services on websites that accept WebMoney payments.

Additionally, WebMoney supports several currencies, including WME (Euro equivalent), WMX (US dollar equivalent), and WMX (Bitcoin equivalent). It also integrates with various platforms, such as games, online stores, social networks, and more.

Frequently Asked Questions (FAQS)

Your unique business goals, transaction volume, features, and merits that best suit your needs will all play a huge role in selecting the ideal PayPal alternative. Here are some common FAQs about PayPal alternatives:

1. Are these alternatives available globally?

Yes, most of the PayPal alternatives provide online payment services and are available throughout the world.

2. How do I ensure the security of my transactions?

You should take platform-specific security measures to guarantee the security of your transactions when using the PayPal alternative. Here are some key guidelines:

- If the alternative payment platform has a two-factor authentication (2FA) option, turn it on. Now, when you want to access your account or confirm transactions, you’ll need a second form of authentication. This adds an extra degree of security.

- Ensure that you have a unique, strong password for each of your accounts. Avoid using easily guessed passwords or personal information.

3. Can I use multiple alternative payment platforms simultaneously?

Yes, you can use more than one alternative payment platform at once. Both individuals and businesses often use multiple payment platforms to meet the needs of differing clientele or to access a range of features.

4. What is the future of online payments?

Online payments are probably going to be safer, more convenient, and more diverse in the future than they have ever been. Various sources show that the following trends will influence the digital payments industry in the upcoming years.

- The use of cutting-edge authentication technology, such as biometrics and facial recognition, will improve online payment security and the user experience.

- The extinction of physical cards and cash in favor of contactless and digital payment systems.

- Cross-border and cross-currency payments are going to rise, allowing for fast and convenient transactions around the world.

As a user, you should be prepared to embrace additional developments in the online payments space, as new regulations and inventions will keep changing how you pay and get paid.

Conclusion

These are a few of the most widely used payment options you can opt for especially Freelancers and Bloggers. So, as you can see, the market is flooded and does not lack any payment processing technologies.

If you own a shop or are looking for an in-store payment option, you can also check out Payline, Shopify, Square, Intuit, and Authorize.net.

However, be wary of scammers, as they are constantly on the run to hack these payment platforms. We hope this post helps you pick the best PayPal alternative and launch your freelance business.

In case you think we are missing out on something, please do let us know so that we can share it with our other freelancer friends. Also, do let us know which is the alternative you use and why, by writing in our comment section below. Till then, Happy Working and Happy Earning!

I think you missed revolut. It is in the same category as Transferwire